Market Overview

The Tampa office market is the largest in the State of Florida, with more than 128 million SF of inventory. The market has experienced weakening economic conditions and reduced leasing activity since Covid-19. The pandemic forced many businesses to adopt remote work policies and flexible schedules. This has caused many companies to reevaluate their need for traditional office space and repurpose or downsize their existing space. With decreased demand and increased vacancy rates, tenants have had more leverage in negotiating lease terms.

The core submarkets include Westshore and Downtown Tampa due to the easily accessible top-tier construction and class A product. The suburban submarkets including Gateway, Northwest Tampa, and East Tampa, have faced challenges due to their focus on commodity assets in sprawling corporate campuses with limited amenities. These submarkets have traditionally catered to businesses looking for large office spaces in suburban settings. However, changing market dynamics and shifting preferences have impacted their performance.

Vacancy

The changing needs of office users have resulted in significant consequences within the Tampa market. These macro-trends have led to a historically high level of sublease space, lingering vacancy in some newly constructed projects, and the highest number of vacant office buildings in the State of Florida. As of the second quarter of 2023, the overall vacancy rate stands at 9.3%, remaining relatively unchanged compared to the previous year. Over the past year, the market has experienced negative absorption, with a decrease of 99,000 SF in occupied office space. However, there was a positive trend in the first quarter of 2023, marking the first time in a year, driven by increased occupancy in Downtown Tampa, Pasco County, and Westshore.

The high level of sublease space indicates that companies are looking to downsize or offload excess office space. Lingering vacancy in new construction projects suggests that the supply has outpaced demand in certain areas. Despite these challenges, the positive absorption in key submarkets such as Downtown Tampa, Pasco County, and Westshore indicates some areas of resilience and potential for growth. It suggests that certain locations have been successful in attracting occupiers and meeting their evolving needs.

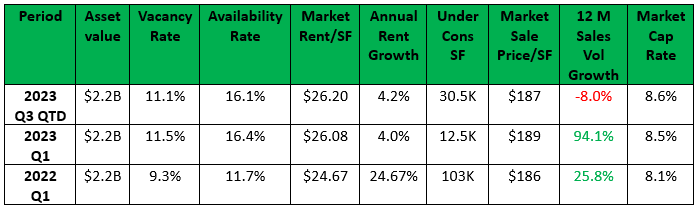

East Tampa – Tampa, FL

Overview

The East Tampa office submarket is one of the weakest-performing submarkets in the area. This region houses numerous corporate campuses, with notable tenants including Citigroup, USAA, and JP Morgan, occupying expansive areas spanning hundreds of thousands of square feet. Both the submarket and other suburban areas in Tampa have experienced notable effects due to employers actively seeking office spaces that can draw employees back to the workplace. These spaces are designed to be efficient, centrally located, and offer enhanced amenities catering to their employees’ needs.

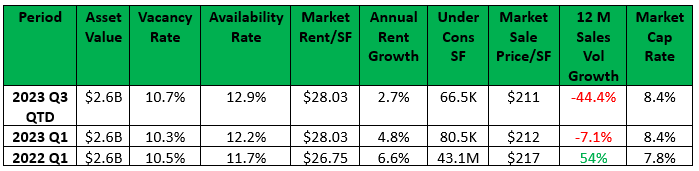

Vacancy and Rent Growth

There has been a significant amount of tenant move-outs in East Tampa due to Downtown Tampa and Westshore’s prime location, causing record negative absorption and rising vacancy rates. CoStar noted, as of the second quarter of 2023, vacancy increased 1.0% year over year to 10.7%. Over the past 12 months, the submarket has posted -77,000 SF of absorption, making it one of the top submarkets in tenant move-outs.

There are many vacant parcels that inhabit this submarket that are available for lease or even sublease, as tenants have vacated prior to lease expiration. For example, Ford Motor Credit, which leases 120,500 SF at Sabal Pavilion I vacated its entire building in the second quarter of 2022 and put it on the sublease market with a lease expiration in early 2026. Despite historic levels of vacancy, asking rents continue to rise. Asking rents increased 2.7% YOY, which is forecasted to slow in the near quarters.

Westshore – Tampa, FL

Overview

Westshore is Tampa’s primary suburban submarket, competing for larger tenants seeking high-end space. This area has one of the highest concentrations of top-tier properties, including several of Tampa’s newest office buildings. Westshore contains headquarters for companies in tech, information, finance, insurance and healthcare sectors. While overall fundamentals are improving, Westshore has experienced the impact of changing square footage requirements for the post-pandemic workforce.

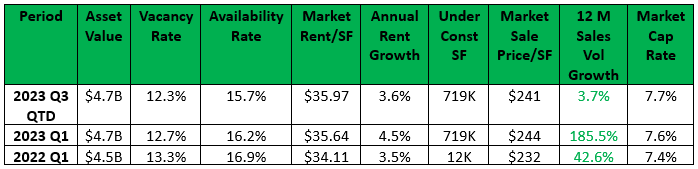

Vacancy and Rent Growth

As of the second quarter of 2023 vacancy is 12.0%, this is a decline of 1.9% YOY but still above the market rate of 9.2%. CoStar predicts that the vacancy rate will remain elevated but stay below 15% over the next 18 to 24 months. With the delivery of a new office building in Midtown, vacancy rates will likely go up. Midtown Place is an 18-story, 428,000-SF, Class A building planned by The Bromley Companies, it is expected to be completed in late 2024. Tampa Electric Co. (TECO) has purchased 11 stories, leaving the remaining 132,000 SF for lease. Westshore commands the highest asking rent in Tampa at $35.00/SF, slightly higher than the asking rate of Downtown Tampa. Westshore’s asking rates are expected to continue to rise, especially with the release of the asking rate for Midtown Place, at $46/SF on a triple-net basis.

downtown – Tampa, FL

Overview

Downtown Tampa’s is Tampa’s most sought-after submarket with approximately 11.4 million SF of office space. The submarket is home to several law firms, engineering firms, as well as real estate companies in addition to a strong government presence.

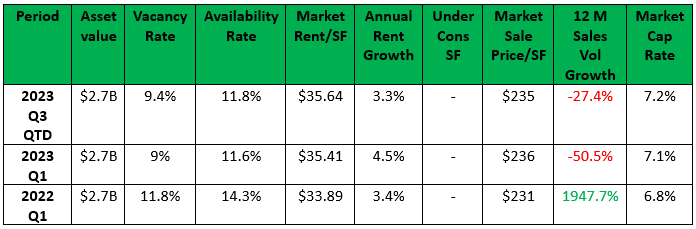

Vacancy and Rent Growth

Vacancy rates peaked at 13% in the fourth quarter of 2021 with the delivery of Thousand & One, ever since vacancy has been on a steady decline. Vacancy decreased -0.5% YOY to 9.3% as of the second quarter of 2023. Before the pandemic vacancy was at 5.9% at the end of 2019, which is an all time low. There is still a high demand form space, with approximately 44,000 SF absorbed over the past 12 months. A large portion of the occupancy gains have been a result of Water Street Development. Despite the national downsizing trend, this submarket sees firms relocating and expanding, showing limited popularity for downsizing.

Johnson Pope leased the top two floors (33,175 SF) at Rivergate Tower, leaving its 20,025 SF space in Truist Place. Additionally, Bradley announced that it will be relocating from its 20,000-SF office in 100 N Tampa and nearly doubling its footprint in its new 37,000-SF space in Thousand & One. Asking rates in Downtown Tampa are up 2.9% YOY, just surpassing $35/SF. Buildings rated 4 and 5 star now average $40/SF. Thousand & One is forecasted to have the highest asking rent in Tampa at $55/SF.

Northeast Tampa – Tampa, FL

Overview

The Northeast Tampa submarket is one of the areas larger suburban markets, with 11.5 million SF of office space. There is a larger residential area in Northeast Tampa that is supported by the University of South Florida, along with protected land that cannot be touched by developers. MetLife, USAA, and Verizon Wireless are some of the corporate campuses that inhabit the submarket.

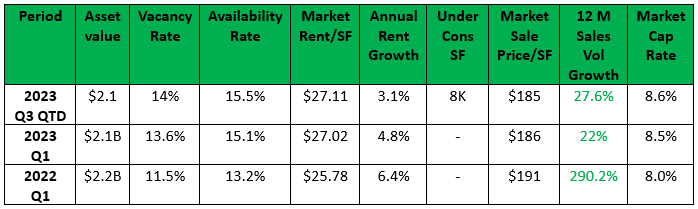

Vacancy and Rent Growth

The Northeast Tampa submarket has the highest vacancy rate in Tampa, at 14%. There has been a recorded loss of 260,000 SF over the past year, increasing the vacancy rate 2.2% YOY. There have been predictions of that office product will be redeveloped into industrial or multifamily. There have been large vacant properties that have been on the market for more than a year. For example, T-Mobile vacated approximately 115,000 SF in Highwoods Preserve V in the first quarter of 2020, less 20,000 SF has been leased. MetLife also has 61,000-SF up for sublease in the building and has been on the market for nearly a year. The submarket currently has an average asking rent of $27.00/SF, just below the Tampa’s average of $28.00/SF.

Northwest Tampa – Tampa, FL

Overview

The Northwest Tampa Submarket is one of Tampa’s larger suburban submarkets, with 11.7 million SF of office inventory. The submarket has been plagued by sublease space and rising vacancies. Tenants at Vision Properties Renaissance Center placed their spaces on the sublease market, significantly impacting the market.

Vacancy and Rent Growth

This submarket has the largest concentration of sublease space in the market at 7.9%, well above the overall markets sublease availability rate of 2.8%. The vacancy rate has experienced a 0.3% YOY increase, reaching 11% in Q2 of 2023, the highest since 2016. Absorption totals to 60,000 SF over the past 12 months. There is only 30,000 SF under construction which is just a small fraction of what it was the previous year at 100,000 SF. Xenia Management was the largest project in the past year consisting of 75,000 SF of office space, which is currently 70% vacant. In Northwest Tampa, asking rents are averaging $26/SF, which is 3.8% higher than 2022.

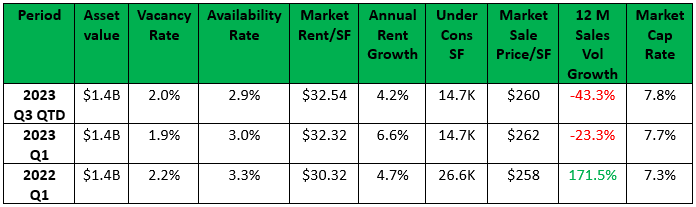

South Tampa – Tampa, FL

Overview

South Tampa is Tampa’s midsize market, with 5.5 million SF of inventory. The submarket mainly consists of residential including, Hyde Park, Culbreath Isles, and Palma Ceia. MacDill Airforce Base also encompasses a large portion of the southern tip of South Tampa. The tenants in this submarket are mainly banks, financial services, legal and some medical to support the local population.

Vacancy and Rent Growth

Vacancy in South Tampa has remained relatively unchanged for the past decade and hasn’t surpassed 6% since 2009. Vacancy rates currently stand at 1.8% as of Q2 of 2023, with a predicted stability in the coming years. There is limited construction in the submarket with only 14,000 SF delivered in 2022 and 15,000 SF currently under construction. Due to the limited availability and aura of exclusivity of obtaining office space in South Tampa, office asking rents are $32.00/SF, which is a 3.7% increases YOY.

*Source – Costar Group