Market Overview

Tampa’s industrial market has experienced rapid growth in the past year, nearly 6 million sf of industrial space has been constructed in Tampa, with 3.5 million currently in progress. Tampa has a prime location, with interstates connecting to Orlando and Lakeland making it easily accessible and a hotspot for manufacturers. Since Covid leasing demand is still up 40% and industrial rents continue to rise by 14% over the 12-month period according to CoStar*.

Sales & Leases

Tampa’s industrial market continues to grow as there is roughly 3.5 million sf underway, with almost 60 percent being preleased. 2023 Q1 experienced nearly 3 million square feet of industrial activity. In the first quarter there was a huge demand for buildings under 100,000 sf as 63% of deals involved parcels less than 100,000 sf. In the last year, 66 percent of leases have been under 20,000 sf. There were four major deals signed in the first quarter with Tesla falling at number one with its 433,154 sf industrial building in Plant City. The other three major deals occurred in the Eastside ranging from 65,000 to 80,000 sf.

Since the demand for industrial space is high with a limited supply, rents were pushed to an all-time high, with $9.75 being the average asking rent per sf. These demand surges have caused upward pressure on rental rates especially with leases expiring in the next 12-24 months.

Vacancy

Many submarkets in Tampa are facing all time low vacancy rates, specifically Downtown Tampa and the Airport/Westchase, with vacancy rates sitting at 1.4% and 1.5%. East Tampa is experiencing large amounts of development and demand for properties which lowered the vacancy rates to 2.5%. Only South Tampa saw a QOQ increase in vacancy after Carvana relinquished 60,000 sf of sublease space. Tampa’s low vacancy rate is projected to remain due to high demand and limited industrial space supply.

East Side – Tampa, FL

Overview

The East Side industrial market makes up more than a quarter of the markets inventory. Its location next to the I-4 corridor provides an advantage to distribution owners. This is why there is such a high demand for space and inventory expansion over the past couple years. The average time an industrial space is available on the market in the East Side is 3.5 months.

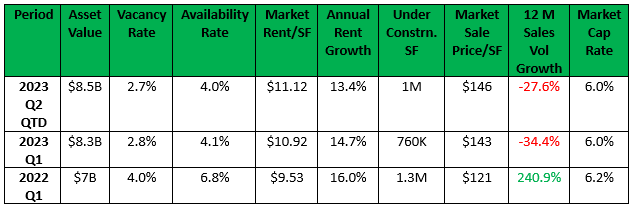

Vacancy and Rent Growth

The strong demand for industrial space in the area has caused a decline in vacancy rates and an accelerating rent growth. Vacancy rates have declined by 1.2% since Q1 2022 and are at a historic low of 2.8%. The one million square feet of active industrial projects is already 50% preleased. Asking rents continue to grow with a year-over-year rent growth of 14.7% in Q1 of 2023. This area possesses some of the lowest asking rates in Tampa at $10.92/SF at the end of Q1 and $11.10/SF currently.

East Hillsborough/ Plant City

Overview

The East Hillsborough and Plant City submarket has been one of the most vigorous submarkets in Tampa. This location is the home to many new construction options and is on the western edge of the I-4 gateway, which makes it such a popular location for distributors.

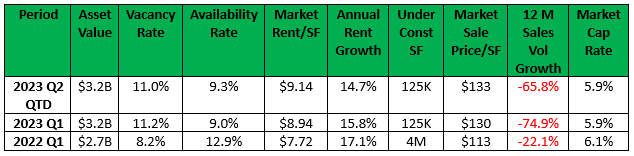

Vacancy and Rent Growth

This submarket makes up almost 60% of Tampa’s absorption rate, with 3.1 million SF absorbed over the last 12 months. Lowe’s makes up a significant portion of the submarket’s absorption due to its 1.2 million-SF distribution facility in Q1 of 2023. Supply outweighs demand in this area because 4.2 million SF was constructed this past year. The supply surge has raised vacancy rates to 11.0% as of Q2 2023, marking the highest in the Tampa market. This submarket is home to the largest existing vacancy in Tampa, the BentallGreenOak’s building along Country Line Road. Big-box leasing constitutes a significant share of vacancies, with 2 tenants securing leases of over 50,000 SF this year. The submarket has some of the lowest asking rents in the Tampa market, currently sitting at $9.10/SF.

Westshore/Airport – Tampa, FL

Overview

The Westshore/Airport Submarket in Tampa is a highly sought-after industrial area that has seen a significant increase in rent prices and record low vacancy rates. It is the fourth largest submarket in Tampa, covering an area around Tampa International Airport.

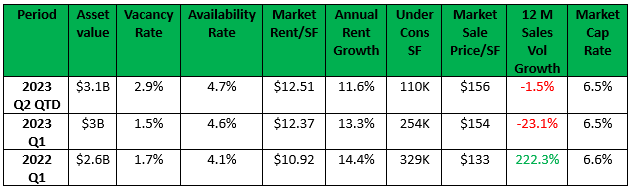

Vacancy and Rent Growth

This submarket has consistently had higher asking rents compared to other submarkets in the region, currently at $12.50/SF NNN. It has outperformed the East Side and E Hillsborough/Plant submarkets, which have lower asking rents of sub-$11/SF and $9/SF, respectively. Asking rents in Westshore/Airport have increased by 11.6% year over year as of the second quarter of 2023. The vacancy rate in this submarket has been steadily decreasing since 2009 and currently stands at just 2.9%, the lowest among all of Tampa’s submarkets with more than 5 million SF of inventory. The submarket’s low vacancy is due to minimal new construction in the past decade, with only around 675,000 SF delivered in recent years after a significant development hiatus since 2009.

Pasco County

Overview

The Pasco County industrial submarket is rapidly growing and is being pursed more aggressively. With approximately 13.4 million SF of inventory, it is considered a midsize submarket in Tampa. Pasco County has the most active construction pipeline in Tampa, surpassing even the dominant development submarkets of East Side and E Hillsborough/Plant City. The largest ongoing construction project is the North Pasco Corporate Center by Harrod Properties, comprising two buildings with a total of 940,000 SF.

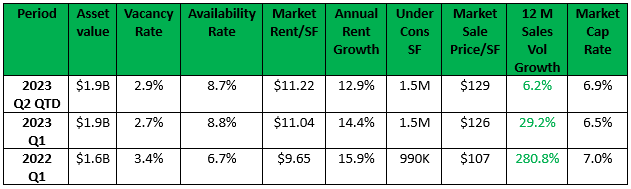

Vacancy and Rent Growth

The low vacancy rate for the second quarter of 2023 is 2.9%. This can be attributed to limited new construction in the past decade. However, recent construction activity has increased, with 1.5 million SF currently under construction, accounting for 11.1% of the market’s inventory. Additionally, there are several proposed multiphase industrial parks, with the largest being Columnar’s Pasco Town Center 75 Industrial, set to feature 4.5 million SF of industrial space upon completion. Phase one will commence in the third quarter of 2023, with buildings ranging from 128,000 SF to 1.5 million SF. Asking rents in Pasco County have significantly increased over the years due to the dominance of new construction availabilities. As of Q2 2023, the asking rent is $11.20/SF, reflecting a 12.9% increase compared to the previous year.

NW Hillsborough

Overview

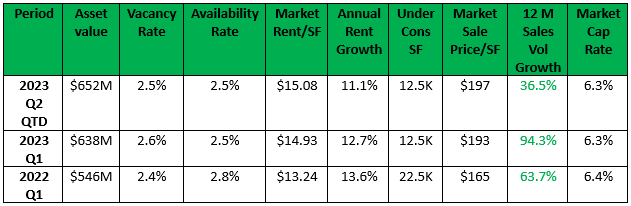

The NW Hillsborough industrial market is growing slowly but surely, an addition of industrial space has caused vacancy rates to rise. The rental market is NW Hillsborough has seen significant growth as rents have increased by about 11.1 percent.

Vacancy and Rent Growth

The NW Hillsborough industrial submarket currently has a vacancy rate of 2.5%, which has increased by 0.7% over the past year. Despite this, there has been negative absorption of 12,000 SF, meaning more space has been vacated than occupied. However, 10,000 SF of new space has been delivered to the market. Rents in the submarket are approximately $15.10/SF, reflecting an 11.1% increase compared to a year ago. Over the past three years, rents have experienced a cumulative growth of 38.7%. In terms of sales activity, there have been 11 sales in the past year, with an average price of $117/SF. The estimated overall value for the entire market is $197/SF.

*Source – Costar Group